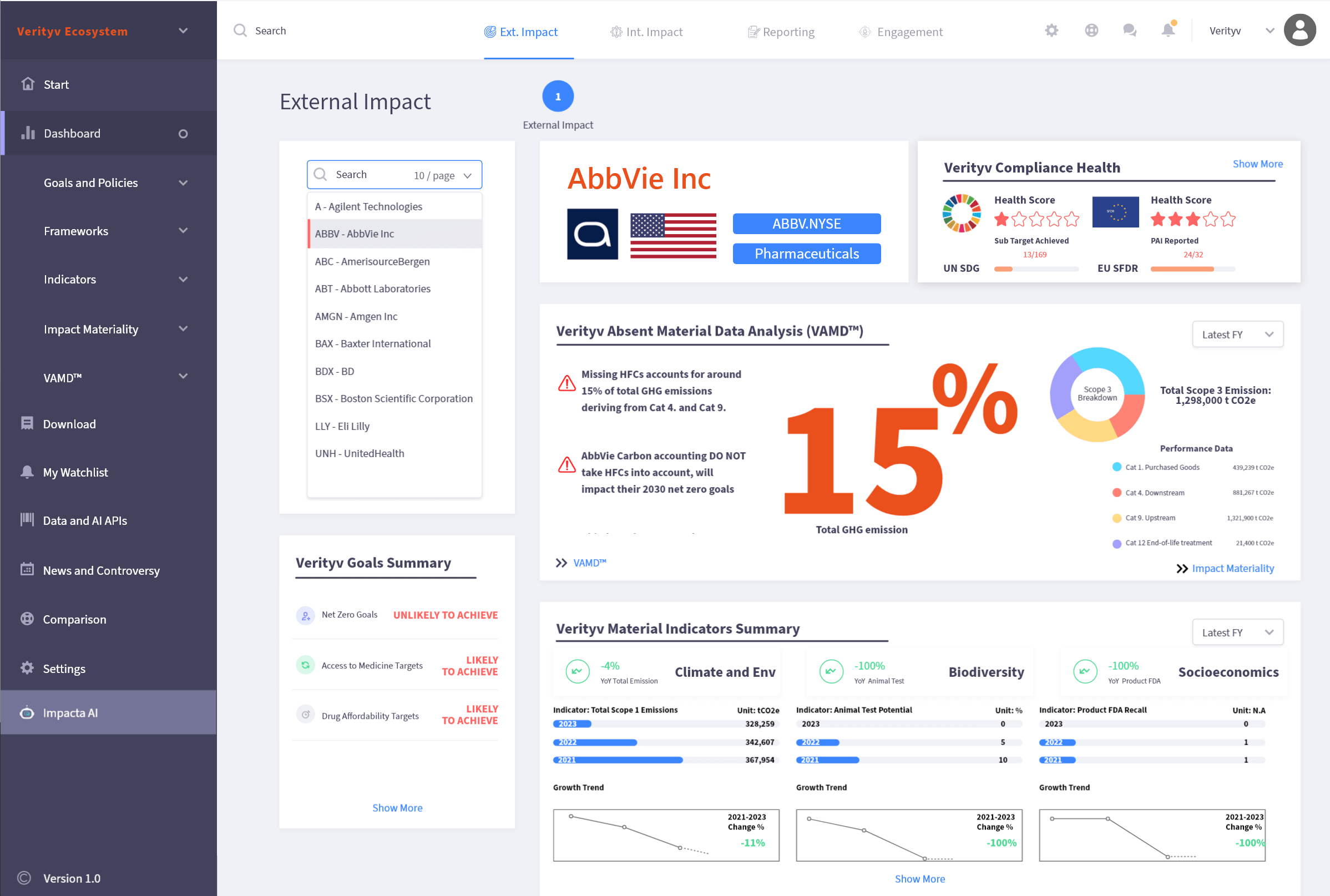

The Ultimate 360-Degree Risk Assessment Tool

Manage your

Risks

Traditional and Non-traditional Financial Risks

Fintech Platform Using Data and LLM

Technology to Better

Dealmaking and Guide Compliance